Author: OpenWorld

Compiled by: Deep Tide TechFlow

Deep Tide Guide: 2025 was a year of dramatic changes for the crypto market. This annual report from OpenWorld provides a deep dive into the listing performance of major centralized exchanges (CEXs) throughout the year with detailed data. Among the 2147 listing events, which sectors were most favored? How did market liquidity change drastically after Bitcoin (BTC) fell below $100,000 in October?

From Binance to Bitget, what are the similarities and differences in the listing strategies of the top-tier exchanges (BCOBB)? This article breaks down the code to CEX listings in 2025, offering insights into valuation distribution, listing timing, and the underlying logic of sector rotation. It is an essential guide to understanding the current barriers to entry in the secondary market.

Full Text Below:

Key Insights into CEX Listings

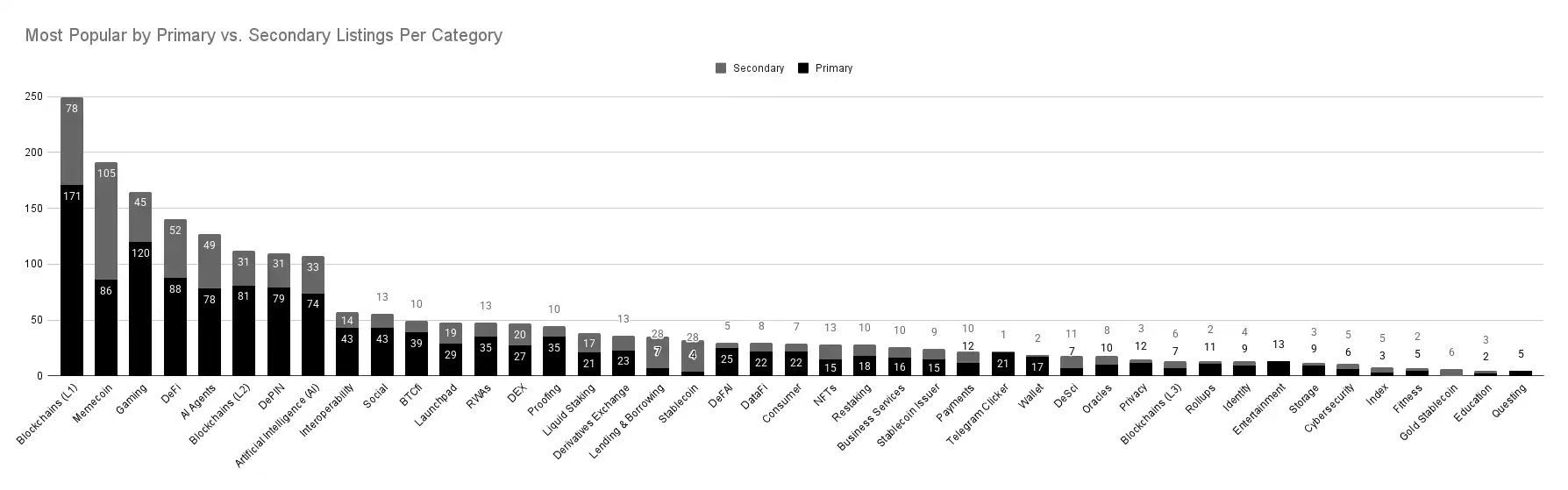

- 2147 listings recorded in 2025: Across the major exchanges we monitored, Primary Listings accounted for 65%.

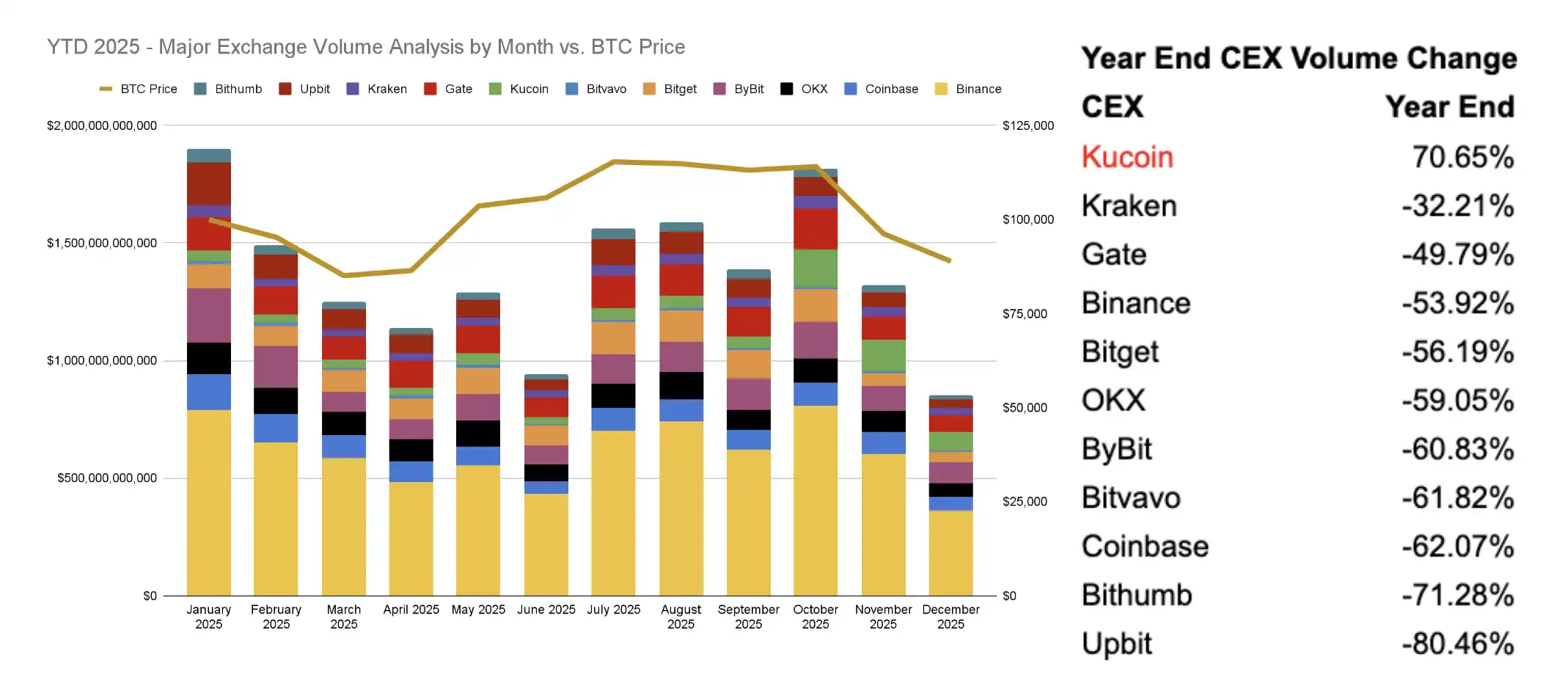

- Most CEXs experienced negative growth in 2025: Kucoin was the only exchange that showed positive growth.

- Trading volume shrank as BTC price fell: Since BTC dropped below $100,000 in October 2025, market trading activity and investor sentiment were hit, leading to a decline in volume.

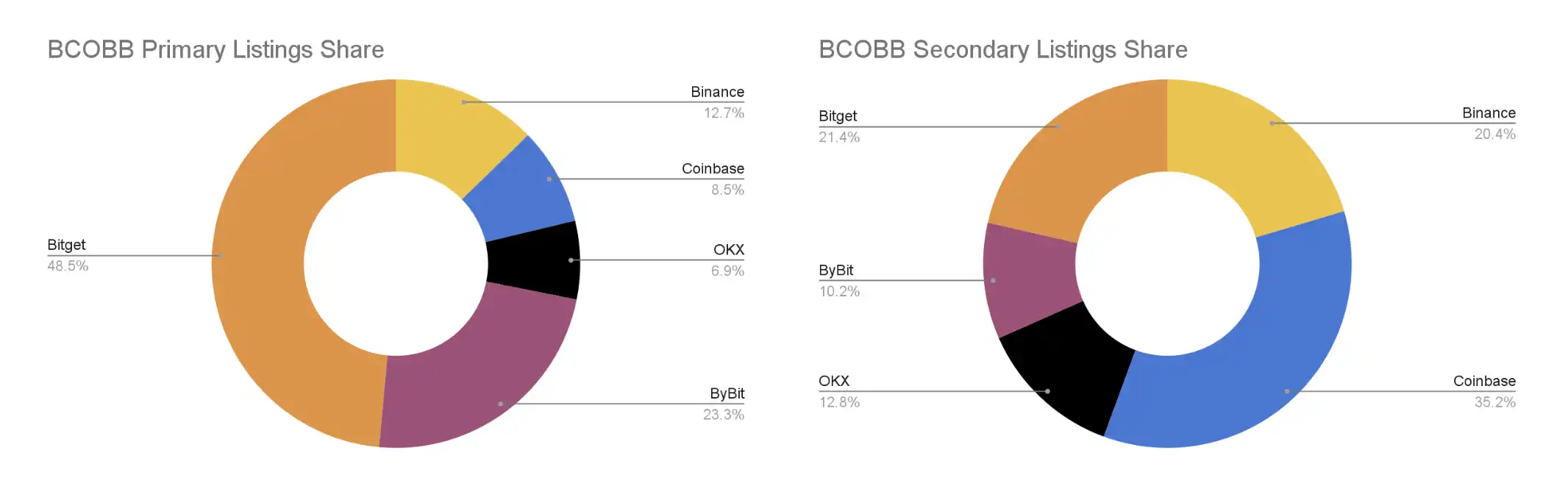

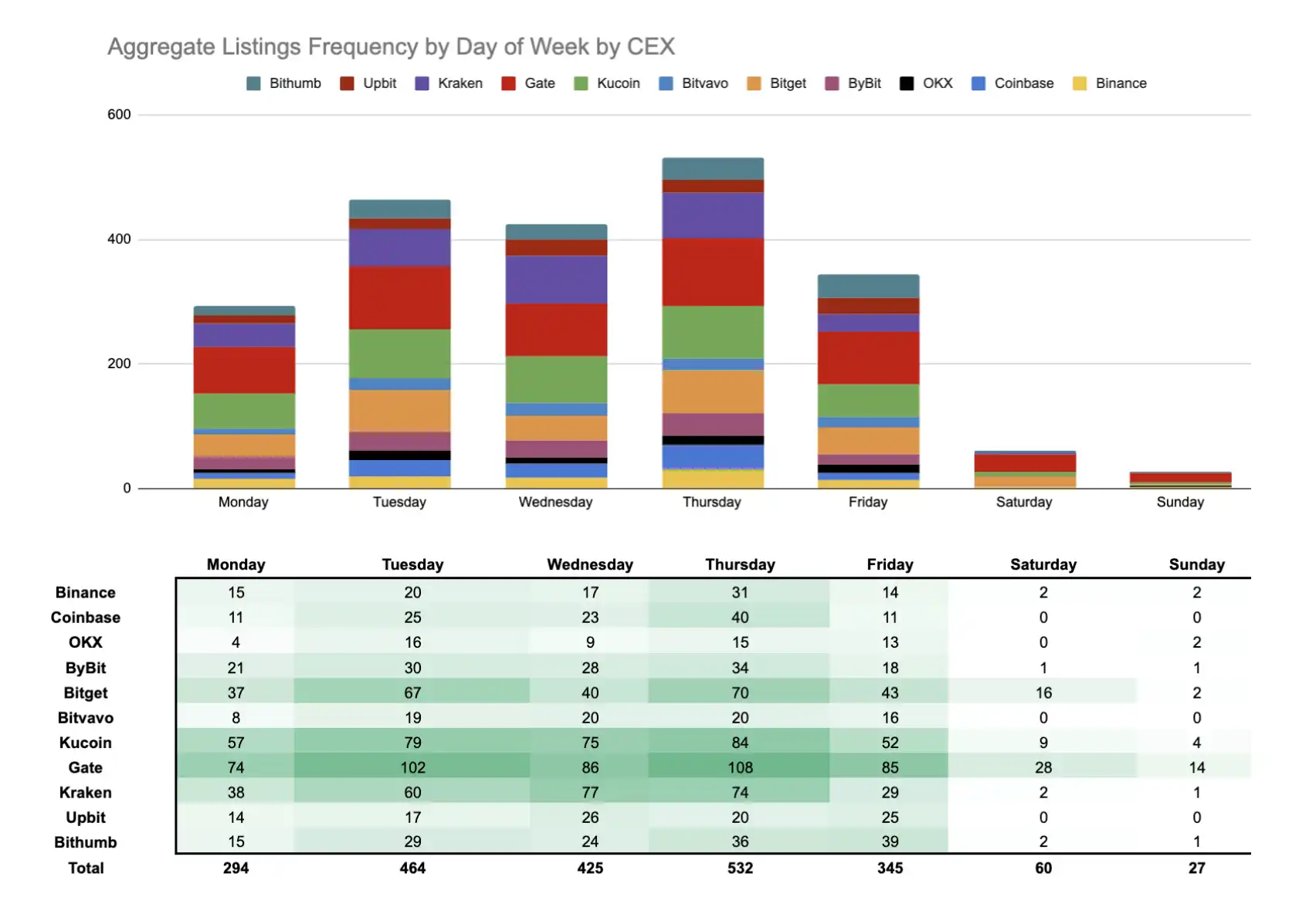

- The first-tier "BCOBB" exchanges listed a total of 678 coins: 71% of these were same-day primary listings, with Bitget accounting for roughly half.

- High-quality AAA-grade TGEs (Token Generation Events) were highly successful: 150 tokens were listed on 2 or more of the "Big 5" exchanges simultaneously.

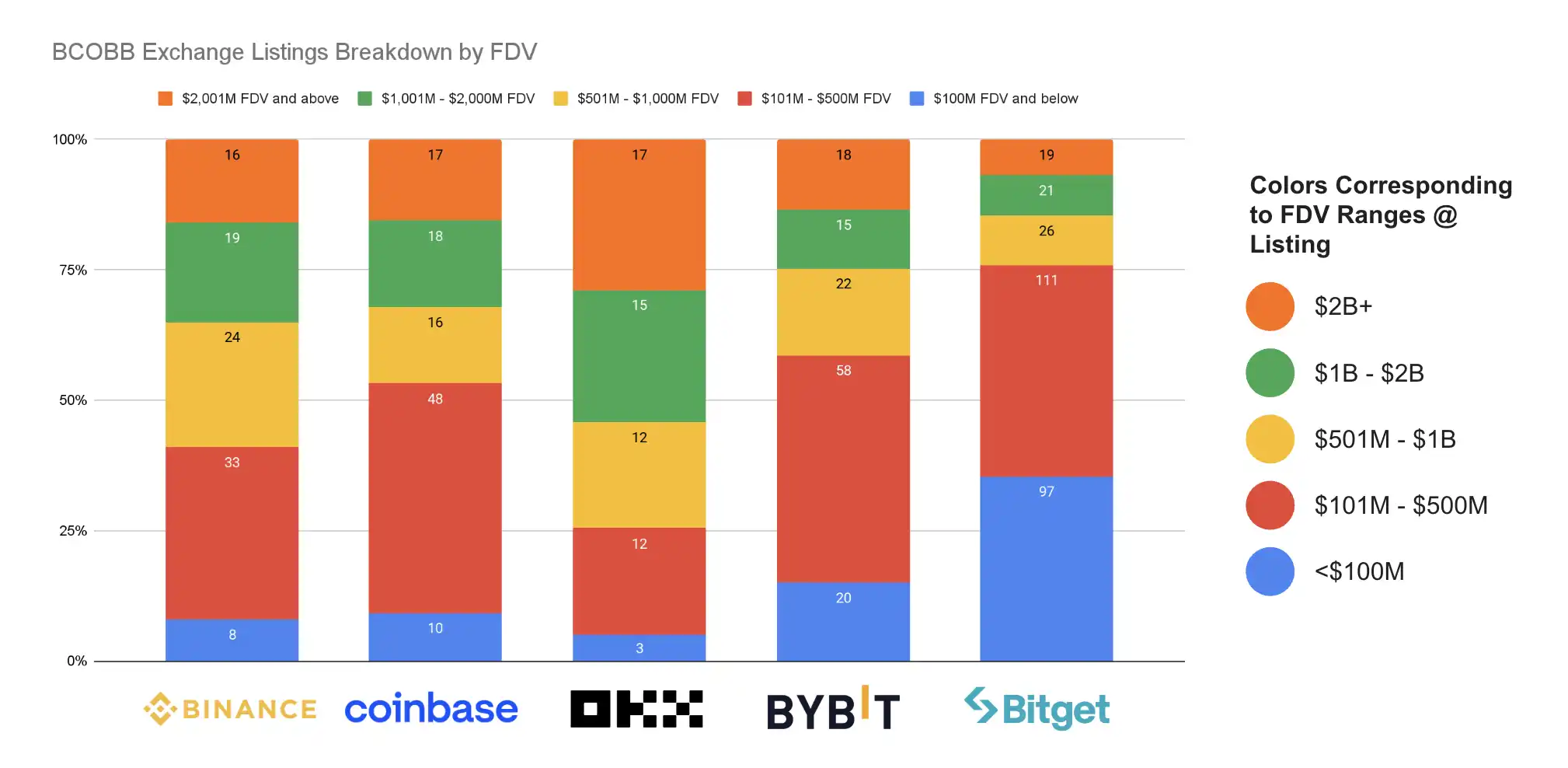

- FDV (Fully Diluted Valuation) Distribution: The FDV of most tokens at listing was concentrated between $101 million and $500 million.

Listing Update: Month-over-Month Overview

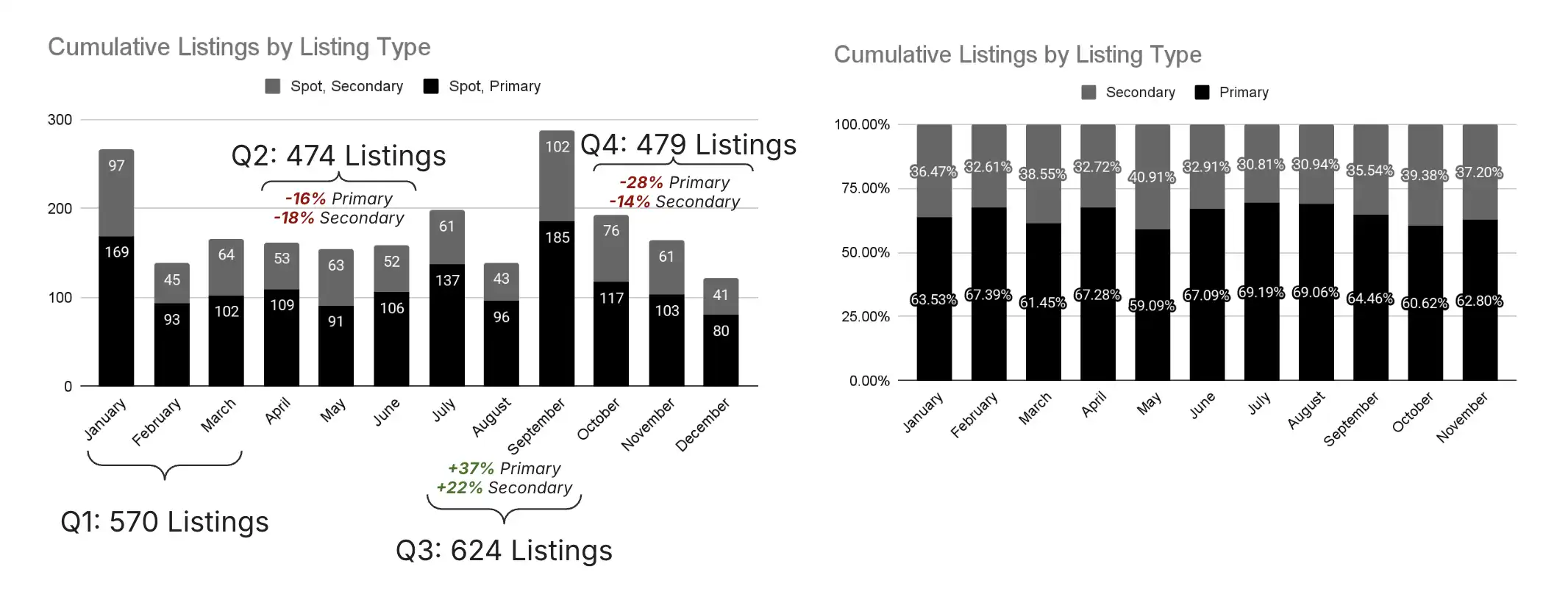

In 2025, the major exchanges we monitored recorded a total of 2147 listings. The fourth quarter saw 479 listings, a decrease of about 23% compared to Q3, a slight increase of about 1% compared to Q2, and a decrease of about 16% compared to Q1.

Tier Snapshot: Comprehensive Overview

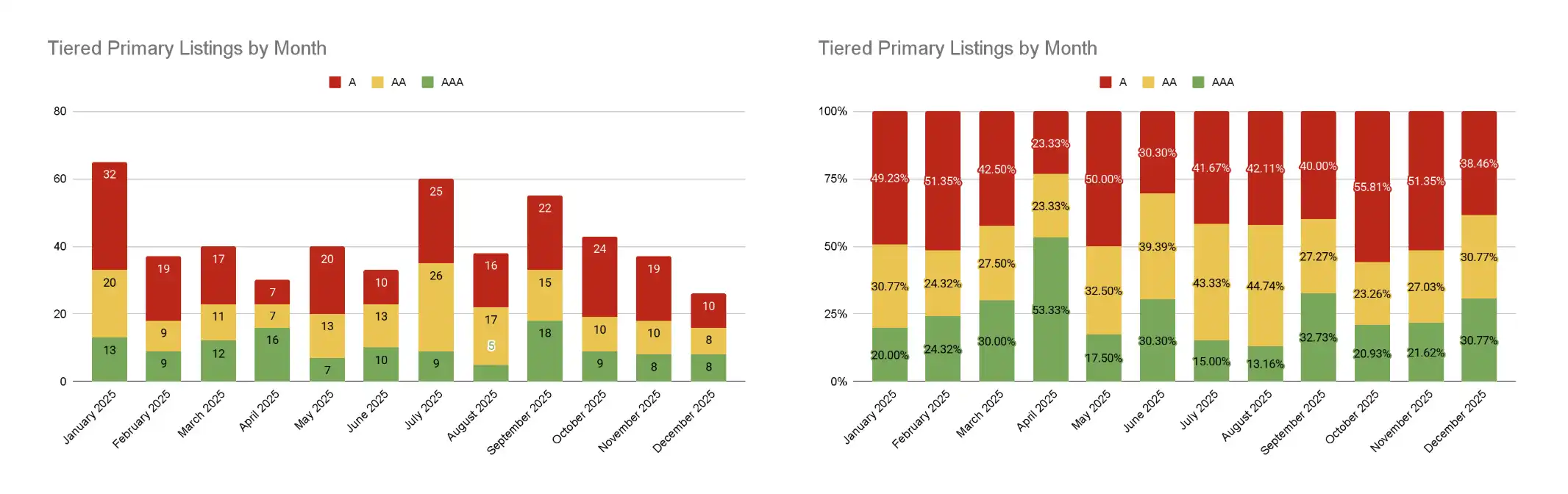

Q1 and Q4 saw a rising trend in high-quality AAA token listings; the quality of listings in Q2 and Q3 fluctuated wildly with extreme variance.

Note: AAA tokens refer to those listed on 2 or more BCOBB exchanges; AA tokens refer to those listed on only 1 BCOBB exchange; A tokens refer to all other tokens not listed on any BCOBB exchange.

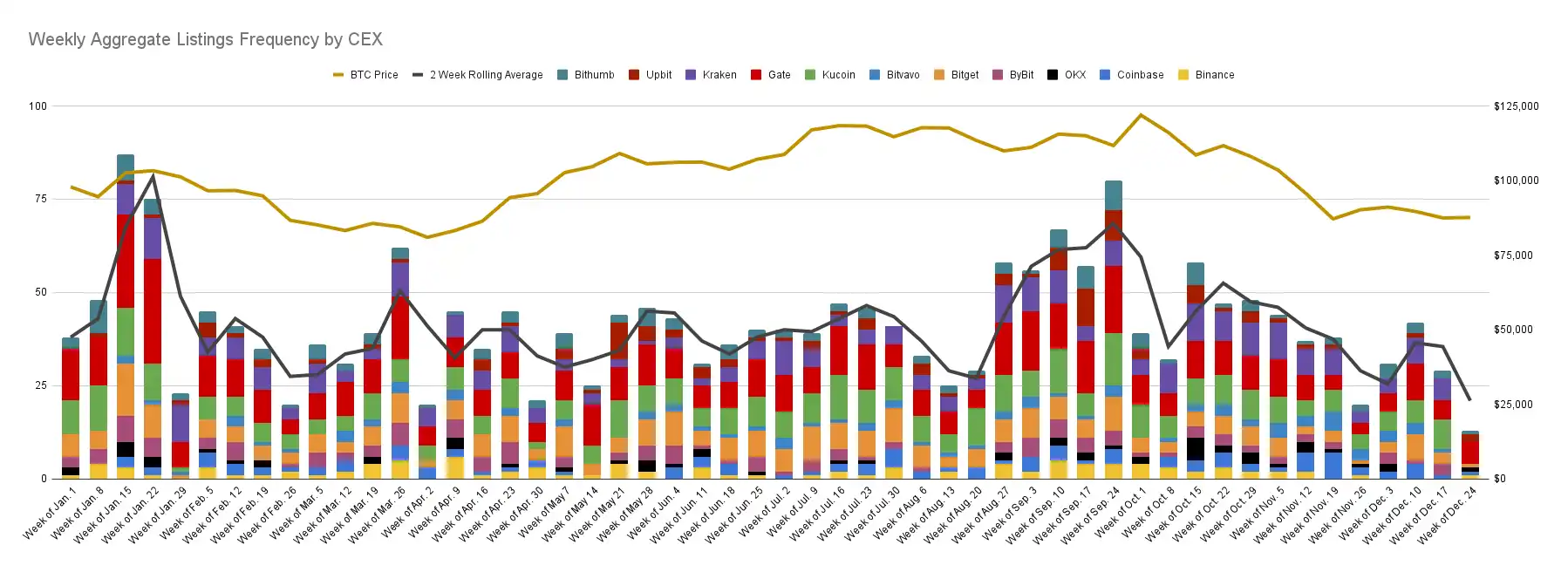

Listing Update: Year-to-Date (YTD) Week-over-Week Overview

Until early October, the number of weekly listings remained relatively stable. However, the altcoin crash on October 10th materially altered the frequency of new coin issuances.

Exchange Volume Snapshot: Month-over-Month Analysis

Following the liquidation event on October 10, 2025, trading volume on major mainstream CEXs shrunk dramatically in Q4. By the end of the year, global cryptocurrency trading volume had decreased by approximately 55%, while BTC's price performance remained relatively flat throughout the 12-month period.

BCOBB Snapshot (Binance, Coinbase, OKX, Bybit, Bitget): Overview

Among the "Big Five" (BCOBB) exchanges, there were 678 listings in 2025. Of these, 479 were primary spot listings, meaning approximately 71% of the listings were primary. A total of 150 tokens were cross-listed on 2 or more of the "Big Five" exchanges.

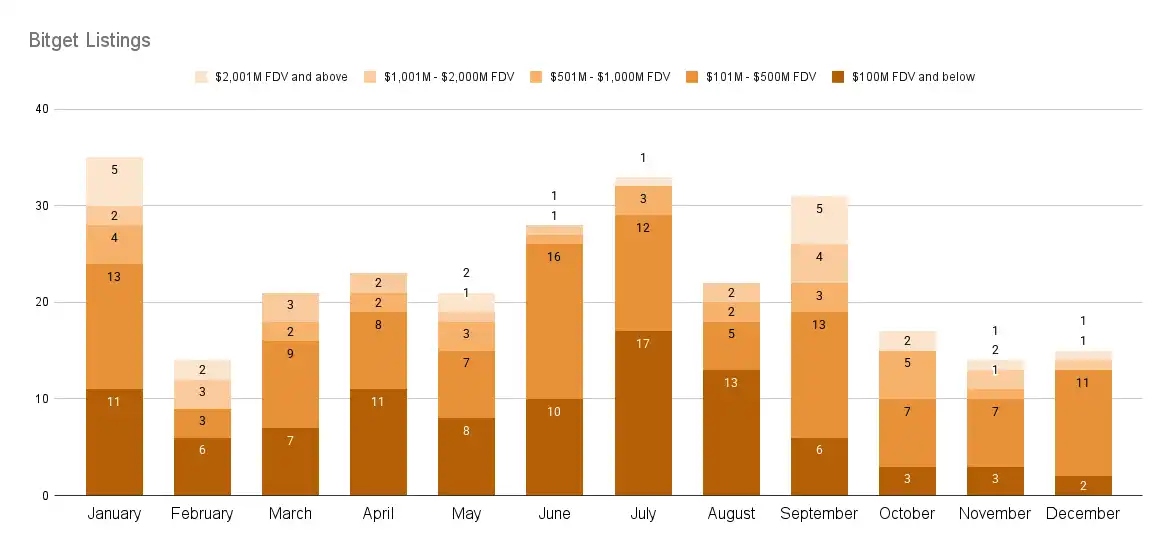

BCOBB Snapshot: FDV Distribution at Listing

In 2025, tokens listed on all major CEXs covered all 5 FDV ranges. The densest distribution was in the $101 million to $500 million range, highlighting strong market interest in projects with lower valuations.

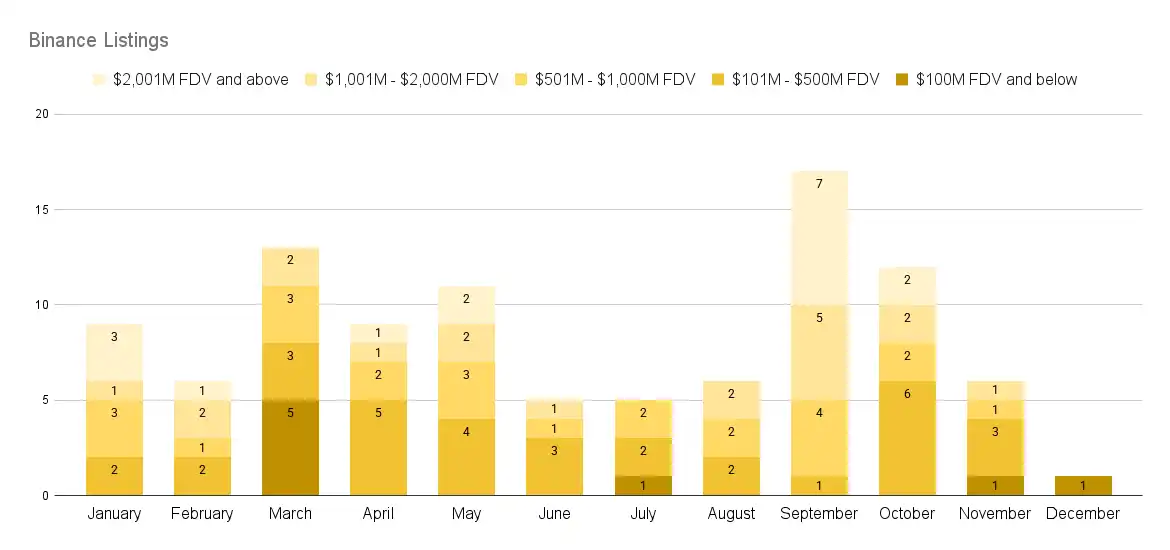

BCOBB Snapshot: Binance

Tokens listed on Binance in 2025 covered all 5 FDV ranges.

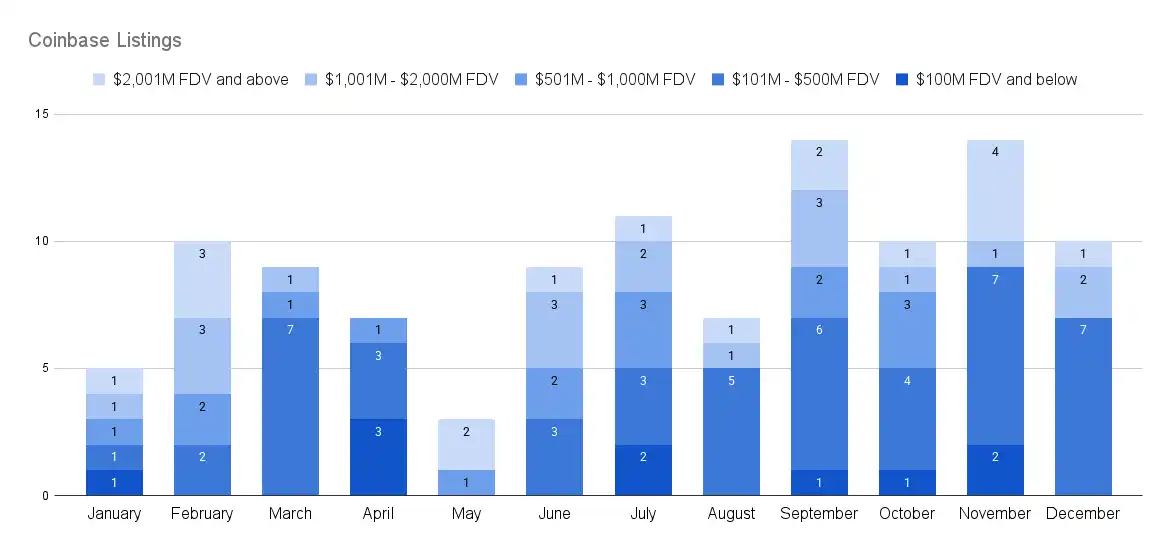

BCOBB Snapshot: Coinbase

Tokens listed on Coinbase in 2025 also covered all 5 FDV ranges.

BCOBB Snapshot: OKX

Tokens listed on OKX in 2025 covered 5 FDV ranges, although no new coins were listed in August 2025.

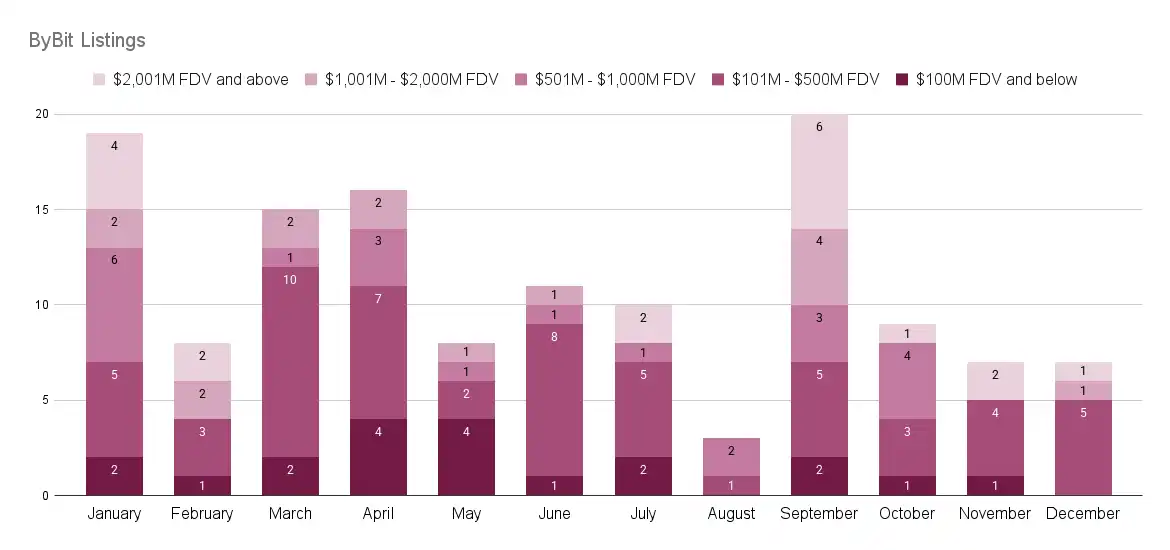

BCOBB Snapshot: Bybit

Tokens listed on Bybit in 2025 covered all 5 FDV ranges.

<极>